Related Vendors

Ramifications of Imbalance

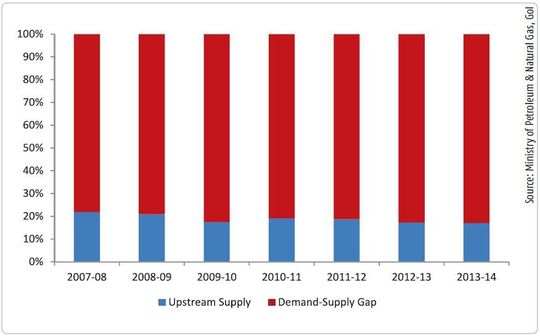

As the gap between downstream demand and upstream supply is filled by import of crude, it has ramifications not only on downstream companies, i.e., oil refiners, but also on the Indian economy as a whole. Oil refiners are exposed to fluctuations in international crude prices as well as exchange rate, and are subject to vagaries of geopolitical situations in supplier countries. In order to insulate themselves from price fluctuations, oil refiners build large inventories of crude.

So, even when prices fall, they suffer inventory losses. For example, IOCL suffered an inventory valuation loss of `150.2 billion during the period April-December 2014 which reduced its gross refining margin significantly.

Crude is India's Biggest Import Commodity

Crude is India’s single largest imported product among all commodities. Over 25 per cent of the total imports of India in US $ have been shared by crude oil over the years (figure 4). Therefore, import of crude is a key factor in determining the country’s trade deficit. It has contributed to over 65 per cent of India’s trade deficit over the years. In 2013–14, crude import exceeded the trade deficit which means trade balance would have been positive had there been no crude import (figure 4).

India’s trade deficit leads to its current account deficit which in turn impacts the balance of payment (BOP) of the country. Thus, any reduction in crude import can improve the BOP, leading to a positive impact on the Indian economy.

National Companies Play have their own Rules

Another repercussion of the upstream-downstream imbalance is that national oil companies are buying stakes in overseas assets to secure the supply of oil and to protect the downstream sector from volatility of international crude prices. The government, too, is encouraging them to acquire oversea assets.

According to the annual report 2013–14 of ONGC, ONGC Videsh Ltd (OVL), a wholly owned subsidiary of ONGC for exploration and production (E&P) activities outside India, has 13 producing assets in eight countries (table 2). The total production from these overseas assets during 2013–14 has been 5.49 MMT of oil. OVL has oil and gas reserves of about 637 MMT of oil equivalent as on March 31, 2014. Similarly, OIL’s overseas E & P portfolio comprises of 14 blocks which are spread over 10 countries covering Libya, Gabon, Nigeria, Yemen, Egypt, Venezuela, USA, Mozambique, Bangladesh and Russia as per its annual report 2013–14.

(ID:43526060)

:quality(80)/p7i.vogel.de/wcms/56/ec/56ecda05b645f0174c02631d95ca9aa4/0128668888v2.jpeg)

:quality(80)/p7i.vogel.de/wcms/e2/dc/e2dc8cc128d8291e54f37ca35e8248e5/0128664847v2.jpeg)

:quality(80)/p7i.vogel.de/wcms/b7/1f/b71f799b120d23d0e02ebd842b8f283d/0128664826v2.jpeg)

:quality(80)/p7i.vogel.de/wcms/d3/e6/d3e627e1a7a3499dee3963b2d92b436e/0128662433v2.jpeg)

:quality(80)/p7i.vogel.de/wcms/0b/c2/0bc2d35b3728c6155bcdc18aa0b4f43e/0128940631v2.jpeg)

:quality(80)/p7i.vogel.de/wcms/ad/82/ad8217d5688276d9ed82b41be17e2edb/0128939746v2.jpeg)

:quality(80)/p7i.vogel.de/wcms/fa/04/fa0408f795513d992edc5f098924e404/0128934009v2.jpeg)

:quality(80)/p7i.vogel.de/wcms/da/7b/da7bec8afb1d52df543beeae45d72a7d/0128897637v2.jpeg)

:quality(80)/p7i.vogel.de/wcms/2c/87/2c879e9ba1bd966c7003802f0b8e1149/0128880738v2.jpeg)

:quality(80)/p7i.vogel.de/wcms/f2/d4/f2d42a2b7ad97329aeafb49c514f63f3/0128879848v2.jpeg)

:quality(80)/p7i.vogel.de/wcms/94/f2/94f2a278fd90b0da7400966874f44950/0128605000v2.jpeg)

:quality(80)/p7i.vogel.de/wcms/1f/52/1f528d0628ffe679a69a2e9f65c0e157/0128668896v2.jpeg)

:quality(80)/p7i.vogel.de/wcms/c1/67/c167f473ddeca77220259be63c52e80f/0128933152v2.jpeg)

:quality(80)/p7i.vogel.de/wcms/51/7a/517a4e83c5827663b4839f5ddb98f434/0128872953v1.jpeg)

:quality(80)/p7i.vogel.de/wcms/6b/76/6b7630a6787b986539ec5cd63bd20309/0128851233v2.jpeg)

:quality(80)/p7i.vogel.de/wcms/ca/ae/caaeba5fe175e8897b288263ea6eb6d3/0128662705v3.jpeg)

:quality(80)/p7i.vogel.de/wcms/be/e1/bee13b8d51a419b9b8f0685e2b9d47bf/0128917673v1.jpeg)

:quality(80)/p7i.vogel.de/wcms/d5/72/d5728578b35b72f365f5086bc1d068da/0128662441v2.jpeg)

:quality(80)/p7i.vogel.de/wcms/a9/69/a96920e47e362a9cf0b9916b7ad3d30a/0128071795v2.jpeg)

:quality(80)/p7i.vogel.de/wcms/3b/fd/3bfda4bbcb1a60004c330bde3b705109/0128453300v2.jpeg)

:quality(80)/p7i.vogel.de/wcms/cc/19/cc19aa5fec6f6f2b25dbd9516efed735/0128077403v2.jpeg)

:quality(80)/p7i.vogel.de/wcms/de/66/de66dd32e1af2fa37ff20bded4417afc/0127787418v2.jpeg)

:quality(80)/p7i.vogel.de/wcms/d5/78/d578d9a15e78a46fad46847d963a04c2/0127547393v2.jpeg)

:quality(80)/p7i.vogel.de/wcms/6b/cc/6bcc3d26e1c7c74d90a10bc3ca296ae1/0128362351v2.jpeg)

:quality(80)/p7i.vogel.de/wcms/24/c8/24c84ab6b1bcd24468a87820a07a85aa/0128194707v2.jpeg)

:quality(80)/p7i.vogel.de/wcms/1d/3e/1d3e2788eb37c1e974f36337c8d33cb5/0128191010v2.jpeg)

:quality(80)/p7i.vogel.de/wcms/19/76/1976928d7d0a2ed7c1eeba7ade8552c8/0126365603v1.jpeg)

:quality(80)/p7i.vogel.de/wcms/b1/3e/b13e690924b3d0318ad71289acfd6b82/0128934399v2.jpeg)

:quality(80)/p7i.vogel.de/wcms/89/8e/898eadf3c417034960d4afb39507d332/0128898269v2.jpeg)

:quality(80)/p7i.vogel.de/wcms/c3/36/c336be5ddcc860374b32bd808d0bbd60/0128897614v2.jpeg)

:quality(80)/p7i.vogel.de/wcms/55/a6/55a603fe7b33bd97422112947873961e/0128880375v2.jpeg)

:quality(80)/p7i.vogel.de/wcms/f8/29/f8298429c1638b949a6f76346f6709c7/0118701710v2.jpeg)

:quality(80)/p7i.vogel.de/wcms/07/24/07242664ab2b1c7841c9d9d0a127670c/0116045959.jpeg)

:quality(80)/p7i.vogel.de/wcms/c9/79/c979a20b32395ddfa93fe7ead90578a0/0108386061.jpeg)

:quality(80)/p7i.vogel.de/wcms/9e/5c/9e5c92d942ed046a27562d6e3d730c92/0103483548.jpeg)

:quality(80)/p7i.vogel.de/wcms/16/3d/163da381529db3a47348a9440655529b/0125732969v2.jpeg)

:quality(80)/p7i.vogel.de/wcms/e7/82/e782bbbf96e4971c22241d76e5de1720/0124855387v2.jpeg)

:quality(80)/p7i.vogel.de/wcms/f9/40/f940b2630f4805f08212fd851af46d6d/0124788233v2.jpeg)

:quality(80)/p7i.vogel.de/wcms/3a/6d/3a6d046cf1db266c3009cecb2af8e2b7/0124656182v2.jpeg)

:quality(80)/p7i.vogel.de/wcms/a8/4e/a84e8039a90a5cf4751d01ebcf6ba1a9/0127510172v2.jpeg)

:quality(80)/p7i.vogel.de/wcms/17/c7/17c703445f134eb3d7ecc7918dda2762/0124596096v2.jpeg)

:quality(80)/p7i.vogel.de/wcms/2a/2c/2a2cffc07f51019065387cd63241b5ce/0119463370v1.jpeg)

:quality(80)/p7i.vogel.de/wcms/b1/7e/b17ea8c62ccafad1d1fb072d6199bbd6/0118578446.jpeg)

:quality(80)/p7i.vogel.de/wcms/a3/f6/a3f6cf659bef4a255272c8af711c20af/0128599957v2.jpeg)

:quality(80)/p7i.vogel.de/wcms/d7/b4/d7b4415fef8a0be11c7f8fd4197edc92/0128599865v2.jpeg)

:quality(80)/p7i.vogel.de/wcms/74/f0/74f0985278cb1fc0e4c79113ecb547e9/0128454101v1.jpeg)

:fill(fff,0)/images.vogel.de/vogelonline/companyimg/2000/2093/65.jpg)

:fill(fff,0)/p7i.vogel.de/companies/61/f9/61f9439b7cbe4/logo-edl.png)

:fill(fff,0)/images.vogel.de/vogelonline/companyimg/103000/103097/65.jpg)

:quality(80)/p7i.vogel.de/wcms/05/37/05377a3492ce2d8b41210569f3f768aa/0124131797v2.jpeg)

:quality(80)/p7i.vogel.de/wcms/c6/2e/c62e5ad6c0283b57390302650125c664/0126391233v2.jpeg)