Related Vendors

Also, foreign investment in hydrocarbon exploration and production is still low despite permission of 100 per cent foreign direct investment (FDI) by the government in this sector. In the recent years, FDI has rather declined in the petroleum and natural gas sector.

Exploration and Production Remained State Monopoly until the 90ies

Until 1991, the exploration and production business in India was the monopoly of the state and was restricted to two national oil companies viz ONGC and OIL. It was only in 1991 that private companies started participating in exploration and production activities.

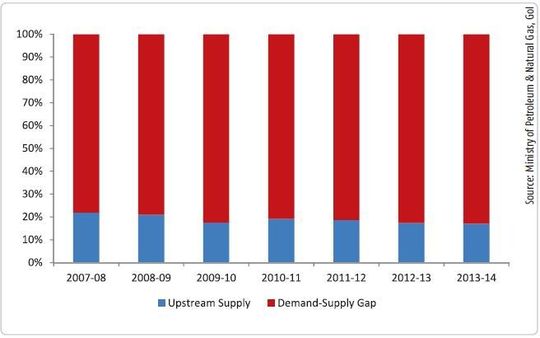

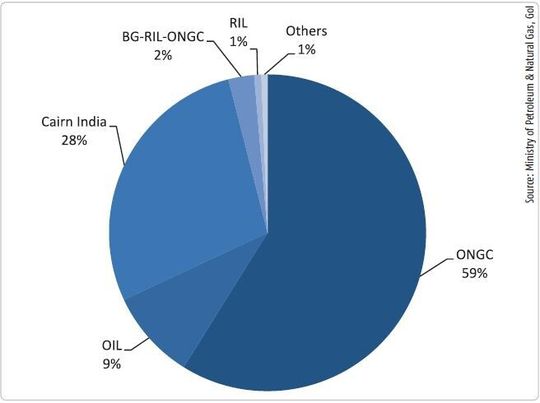

However, despite this, private participation in India’s oil exploration and production is still low. Of the total oil reserves, only less than 15 per cent is shared by private companies and joint ventures (JVs), and over 85 per cent by national oil companies such as ONGC and OIL as on March 31, 2014 (table 1). Similarly, out of the total oil produced since inception till March 31, 2014, national oil companies have produced 91 per cent (ONGC 78 per cent and OIL 13 per cent) and private companies and JVs only 9 per cent. However, over the last several years, the share of private companies and JVs in India’s total oil production has risen significantly.

Discount Prices Affect Oil and Gas Revenues

During 2013–14, their share was 32 per cent, with ONGC’s 59 per cent and OIL’s 9 per cent. Among private companies and JVs, share of Cairn India alone was 28 per cent (figure 3).

Secondly, upstream national oil companies viz ONGC and OIL have been sharing subsidies provided to downstream public sector companies such as Indian Oil Corporation (IOCL), Bharat Petroleum Corporation (BPCL) and Hindustan Petroleum Corporation (HPCL) for selling their regulated products at below-cost prices. This has dented their revenue and profitability significantly, thus, weakening their ability to make investments.

ONGC had to give away nearly 60 per cent of its total revenue in the form of discounts in the prices of its products sold to IOCL, BPCL and HPCL during the first nine months of 2014–15.

Similarly, OIL parted with approximately 78 per cent of its gross income during this period. As nearly 70 per cent of the total oil production still comes from ONGC and OIL, reduction in their profitability can have a direct impact on the overall investment in the upstream sector. However, with recent deregulation of diesel by the government and petrol being already deregulated, the subsidy burden of ONGC and OIL is likely to decline in the future.

(ID:43526060)

:quality(80)/p7i.vogel.de/wcms/56/ec/56ecda05b645f0174c02631d95ca9aa4/0128668888v2.jpeg)

:quality(80)/p7i.vogel.de/wcms/e2/dc/e2dc8cc128d8291e54f37ca35e8248e5/0128664847v2.jpeg)

:quality(80)/p7i.vogel.de/wcms/b7/1f/b71f799b120d23d0e02ebd842b8f283d/0128664826v2.jpeg)

:quality(80)/p7i.vogel.de/wcms/d3/e6/d3e627e1a7a3499dee3963b2d92b436e/0128662433v2.jpeg)

:quality(80)/p7i.vogel.de/wcms/0b/c2/0bc2d35b3728c6155bcdc18aa0b4f43e/0128940631v2.jpeg)

:quality(80)/p7i.vogel.de/wcms/ad/82/ad8217d5688276d9ed82b41be17e2edb/0128939746v2.jpeg)

:quality(80)/p7i.vogel.de/wcms/fa/04/fa0408f795513d992edc5f098924e404/0128934009v2.jpeg)

:quality(80)/p7i.vogel.de/wcms/da/7b/da7bec8afb1d52df543beeae45d72a7d/0128897637v2.jpeg)

:quality(80)/p7i.vogel.de/wcms/2c/87/2c879e9ba1bd966c7003802f0b8e1149/0128880738v2.jpeg)

:quality(80)/p7i.vogel.de/wcms/f2/d4/f2d42a2b7ad97329aeafb49c514f63f3/0128879848v2.jpeg)

:quality(80)/p7i.vogel.de/wcms/94/f2/94f2a278fd90b0da7400966874f44950/0128605000v2.jpeg)

:quality(80)/p7i.vogel.de/wcms/1f/52/1f528d0628ffe679a69a2e9f65c0e157/0128668896v2.jpeg)

:quality(80)/p7i.vogel.de/wcms/c1/67/c167f473ddeca77220259be63c52e80f/0128933152v2.jpeg)

:quality(80)/p7i.vogel.de/wcms/51/7a/517a4e83c5827663b4839f5ddb98f434/0128872953v1.jpeg)

:quality(80)/p7i.vogel.de/wcms/6b/76/6b7630a6787b986539ec5cd63bd20309/0128851233v2.jpeg)

:quality(80)/p7i.vogel.de/wcms/ca/ae/caaeba5fe175e8897b288263ea6eb6d3/0128662705v3.jpeg)

:quality(80)/p7i.vogel.de/wcms/be/e1/bee13b8d51a419b9b8f0685e2b9d47bf/0128917673v1.jpeg)

:quality(80)/p7i.vogel.de/wcms/d5/72/d5728578b35b72f365f5086bc1d068da/0128662441v2.jpeg)

:quality(80)/p7i.vogel.de/wcms/a9/69/a96920e47e362a9cf0b9916b7ad3d30a/0128071795v2.jpeg)

:quality(80)/p7i.vogel.de/wcms/3b/fd/3bfda4bbcb1a60004c330bde3b705109/0128453300v2.jpeg)

:quality(80)/p7i.vogel.de/wcms/cc/19/cc19aa5fec6f6f2b25dbd9516efed735/0128077403v2.jpeg)

:quality(80)/p7i.vogel.de/wcms/de/66/de66dd32e1af2fa37ff20bded4417afc/0127787418v2.jpeg)

:quality(80)/p7i.vogel.de/wcms/d5/78/d578d9a15e78a46fad46847d963a04c2/0127547393v2.jpeg)

:quality(80)/p7i.vogel.de/wcms/6b/cc/6bcc3d26e1c7c74d90a10bc3ca296ae1/0128362351v2.jpeg)

:quality(80)/p7i.vogel.de/wcms/24/c8/24c84ab6b1bcd24468a87820a07a85aa/0128194707v2.jpeg)

:quality(80)/p7i.vogel.de/wcms/1d/3e/1d3e2788eb37c1e974f36337c8d33cb5/0128191010v2.jpeg)

:quality(80)/p7i.vogel.de/wcms/19/76/1976928d7d0a2ed7c1eeba7ade8552c8/0126365603v1.jpeg)

:quality(80)/p7i.vogel.de/wcms/b1/3e/b13e690924b3d0318ad71289acfd6b82/0128934399v2.jpeg)

:quality(80)/p7i.vogel.de/wcms/89/8e/898eadf3c417034960d4afb39507d332/0128898269v2.jpeg)

:quality(80)/p7i.vogel.de/wcms/c3/36/c336be5ddcc860374b32bd808d0bbd60/0128897614v2.jpeg)

:quality(80)/p7i.vogel.de/wcms/55/a6/55a603fe7b33bd97422112947873961e/0128880375v2.jpeg)

:quality(80)/p7i.vogel.de/wcms/f8/29/f8298429c1638b949a6f76346f6709c7/0118701710v2.jpeg)

:quality(80)/p7i.vogel.de/wcms/07/24/07242664ab2b1c7841c9d9d0a127670c/0116045959.jpeg)

:quality(80)/p7i.vogel.de/wcms/c9/79/c979a20b32395ddfa93fe7ead90578a0/0108386061.jpeg)

:quality(80)/p7i.vogel.de/wcms/9e/5c/9e5c92d942ed046a27562d6e3d730c92/0103483548.jpeg)

:quality(80)/p7i.vogel.de/wcms/16/3d/163da381529db3a47348a9440655529b/0125732969v2.jpeg)

:quality(80)/p7i.vogel.de/wcms/e7/82/e782bbbf96e4971c22241d76e5de1720/0124855387v2.jpeg)

:quality(80)/p7i.vogel.de/wcms/f9/40/f940b2630f4805f08212fd851af46d6d/0124788233v2.jpeg)

:quality(80)/p7i.vogel.de/wcms/3a/6d/3a6d046cf1db266c3009cecb2af8e2b7/0124656182v2.jpeg)

:quality(80)/p7i.vogel.de/wcms/a8/4e/a84e8039a90a5cf4751d01ebcf6ba1a9/0127510172v2.jpeg)

:quality(80)/p7i.vogel.de/wcms/17/c7/17c703445f134eb3d7ecc7918dda2762/0124596096v2.jpeg)

:quality(80)/p7i.vogel.de/wcms/2a/2c/2a2cffc07f51019065387cd63241b5ce/0119463370v1.jpeg)

:quality(80)/p7i.vogel.de/wcms/b1/7e/b17ea8c62ccafad1d1fb072d6199bbd6/0118578446.jpeg)

:quality(80)/p7i.vogel.de/wcms/a3/f6/a3f6cf659bef4a255272c8af711c20af/0128599957v2.jpeg)

:quality(80)/p7i.vogel.de/wcms/d7/b4/d7b4415fef8a0be11c7f8fd4197edc92/0128599865v2.jpeg)

:quality(80)/p7i.vogel.de/wcms/74/f0/74f0985278cb1fc0e4c79113ecb547e9/0128454101v1.jpeg)

:fill(fff,0)/images.vogel.de/vogelonline/companyimg/2000/2093/65.jpg)

:fill(fff,0)/p7i.vogel.de/companies/61/f9/61f9439b7cbe4/logo-edl.png)

:fill(fff,0)/images.vogel.de/vogelonline/companyimg/103000/103097/65.jpg)

:quality(80)/p7i.vogel.de/wcms/05/37/05377a3492ce2d8b41210569f3f768aa/0124131797v2.jpeg)

:quality(80)/p7i.vogel.de/wcms/c6/2e/c62e5ad6c0283b57390302650125c664/0126391233v2.jpeg)