Oil Prices Blessing or Curse? The Impact of Global Crude Oil Prices on India's Industry

Global crude prices have fallen by nearly 55 per cent since June 2014 primarily owing to over-supply and sluggish demand caused by economic slowdown in China. Global benchmark Brent crude price has fallen from $111.80 per barrel in June 2014 to $46.58 per barrel in August 2015. As approximately 85 per cent of Indian refineries’ throughput requirement is met through imports, the price of the Indian basket of crude too has fallen by 57 per cent during the said period reflecting the global trend. This has impacted not only the Indian refining industry but also the up-stream oil and gas industry as well as the Indian economy as a whole.

Related Vendors

The refining industry consists of companies such as Indian Oil Corporation, Bharat Petroleum Corporation, Hindustan Petroleum Corporation, Chennai

Petroleum Corporation ( CPCL), Mangalore Refinery and Petrochemicals Ltd (MRPL), Reliance Industries (RIL), Essar Oil Ltd (EOL), etc.

Whereas, major companies belonging to the upstream industry are Oil and Natural Gas Corporation (ONGC), Oil India (OIL), Cairn India and Reliance Industries (RIL).

Impact on refining industry

The prices of major petroleum products viz., diesel, petrol and jet fuel/kerosene in Singapore, the Asian bench mark, have not fallen in the same proportion as crude. Instead, they have fallen by a lesser degree. Prices of premium gasoline, regular gasoline, jet fuel/kerosene and diesel fell by 38 per cent, 49 per cent, 52 per cent and 49 per cent, respectively in the Singapore market between June 2014 and August 2015.

Domestic prices of these products fell by even a lesser degree which also factored the exchange rate of the Indian Rupee (INR) with respect to US$. The Rupee depreciated by 12 per cent against the US$ during the said period.

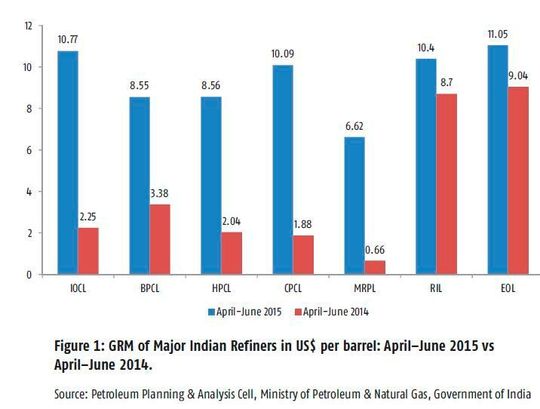

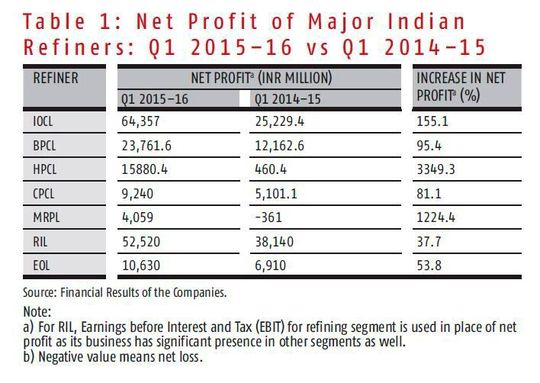

Therefore, falling crude prices coupled with Rupee depreciation has resulted into net gain to Indian refiners as reflected in their gross refining margin (GRM) for the first quarter 2015–16 vis-à-vis the first quarter 2014–15 (figure 1). This is also reflected in hefty increase in their net profit (table 1).

Impact on upstream industry

The fall in global crude prices has impacted private and public sector upstream companies differently because of the latter’s contribution to the subsidy given to state-run refiners for selling the regulated products at below-cost price, and the subsidy declined with decline in crude prices.

As the oil price realized by upstream companies is linked to the international price, private companies have suffered losses, which are reflected in their financial performance. Cairn India’s income shrank by 40.9 per cent during April–June 2015–16 over the corresponding period of 2014–15. While, RIL’s oil and gas business revenue plummeted by 35.3 per cent. Similarly, Cairn India’s net profit and RIL’s Earnings before Interest and Tax (EBIT) for the segment business contracted substantially (table 2).

(ID:43719450)

:quality(80)/p7i.vogel.de/wcms/f7/f0/f7f0fdf4a4e1d872d078d63abfa4a7fd/0127844838v2.jpeg)

:quality(80)/p7i.vogel.de/wcms/1e/50/1e5099910c2370ad08d578161f3fe3c2/0128939735v1.jpeg)

:quality(80)/p7i.vogel.de/wcms/56/ec/56ecda05b645f0174c02631d95ca9aa4/0128668888v2.jpeg)

:quality(80)/p7i.vogel.de/wcms/e2/dc/e2dc8cc128d8291e54f37ca35e8248e5/0128664847v2.jpeg)

:quality(80)/p7i.vogel.de/wcms/e7/40/e74003abab999d9c5ff06672ed899136/0128971984v2.jpeg)

:quality(80)/p7i.vogel.de/wcms/0b/c2/0bc2d35b3728c6155bcdc18aa0b4f43e/0128940631v2.jpeg)

:quality(80)/p7i.vogel.de/wcms/ad/82/ad8217d5688276d9ed82b41be17e2edb/0128939746v2.jpeg)

:quality(80)/p7i.vogel.de/wcms/fa/04/fa0408f795513d992edc5f098924e404/0128934009v2.jpeg)

:quality(80)/p7i.vogel.de/wcms/2c/87/2c879e9ba1bd966c7003802f0b8e1149/0128880738v2.jpeg)

:quality(80)/p7i.vogel.de/wcms/f2/d4/f2d42a2b7ad97329aeafb49c514f63f3/0128879848v2.jpeg)

:quality(80)/p7i.vogel.de/wcms/94/f2/94f2a278fd90b0da7400966874f44950/0128605000v2.jpeg)

:quality(80)/p7i.vogel.de/wcms/1f/52/1f528d0628ffe679a69a2e9f65c0e157/0128668896v2.jpeg)

:quality(80)/p7i.vogel.de/wcms/cf/5b/cf5b66e0b2268fdadb5e20fd585edebb/0128971089v2.jpeg)

:quality(80)/p7i.vogel.de/wcms/c1/67/c167f473ddeca77220259be63c52e80f/0128933152v2.jpeg)

:quality(80)/p7i.vogel.de/wcms/51/7a/517a4e83c5827663b4839f5ddb98f434/0128872953v1.jpeg)

:quality(80)/p7i.vogel.de/wcms/be/e1/bee13b8d51a419b9b8f0685e2b9d47bf/0128917673v1.jpeg)

:quality(80)/p7i.vogel.de/wcms/d5/72/d5728578b35b72f365f5086bc1d068da/0128662441v2.jpeg)

:quality(80)/p7i.vogel.de/wcms/a9/69/a96920e47e362a9cf0b9916b7ad3d30a/0128071795v2.jpeg)

:quality(80)/p7i.vogel.de/wcms/3b/fd/3bfda4bbcb1a60004c330bde3b705109/0128453300v2.jpeg)

:quality(80)/p7i.vogel.de/wcms/cc/19/cc19aa5fec6f6f2b25dbd9516efed735/0128077403v2.jpeg)

:quality(80)/p7i.vogel.de/wcms/de/66/de66dd32e1af2fa37ff20bded4417afc/0127787418v2.jpeg)

:quality(80)/p7i.vogel.de/wcms/d5/78/d578d9a15e78a46fad46847d963a04c2/0127547393v2.jpeg)

:quality(80)/p7i.vogel.de/wcms/6b/cc/6bcc3d26e1c7c74d90a10bc3ca296ae1/0128362351v2.jpeg)

:quality(80)/p7i.vogel.de/wcms/24/c8/24c84ab6b1bcd24468a87820a07a85aa/0128194707v2.jpeg)

:quality(80)/p7i.vogel.de/wcms/1d/3e/1d3e2788eb37c1e974f36337c8d33cb5/0128191010v2.jpeg)

:quality(80)/p7i.vogel.de/wcms/19/76/1976928d7d0a2ed7c1eeba7ade8552c8/0126365603v1.jpeg)

:quality(80)/p7i.vogel.de/wcms/d4/ba/d4ba61e95ad0cdd0e150bb37d0f93afe/0128971702v2.jpeg)

:quality(80)/p7i.vogel.de/wcms/b1/3e/b13e690924b3d0318ad71289acfd6b82/0128934399v2.jpeg)

:quality(80)/p7i.vogel.de/wcms/89/8e/898eadf3c417034960d4afb39507d332/0128898269v2.jpeg)

:quality(80)/p7i.vogel.de/wcms/c3/36/c336be5ddcc860374b32bd808d0bbd60/0128897614v2.jpeg)

:quality(80)/p7i.vogel.de/wcms/f8/29/f8298429c1638b949a6f76346f6709c7/0118701710v2.jpeg)

:quality(80)/p7i.vogel.de/wcms/07/24/07242664ab2b1c7841c9d9d0a127670c/0116045959.jpeg)

:quality(80)/p7i.vogel.de/wcms/c9/79/c979a20b32395ddfa93fe7ead90578a0/0108386061.jpeg)

:quality(80)/p7i.vogel.de/wcms/9e/5c/9e5c92d942ed046a27562d6e3d730c92/0103483548.jpeg)

:quality(80)/p7i.vogel.de/wcms/16/3d/163da381529db3a47348a9440655529b/0125732969v2.jpeg)

:quality(80)/p7i.vogel.de/wcms/e7/82/e782bbbf96e4971c22241d76e5de1720/0124855387v2.jpeg)

:quality(80)/p7i.vogel.de/wcms/f9/40/f940b2630f4805f08212fd851af46d6d/0124788233v2.jpeg)

:quality(80)/p7i.vogel.de/wcms/3a/6d/3a6d046cf1db266c3009cecb2af8e2b7/0124656182v2.jpeg)

:quality(80)/p7i.vogel.de/wcms/a8/4e/a84e8039a90a5cf4751d01ebcf6ba1a9/0127510172v2.jpeg)

:quality(80)/p7i.vogel.de/wcms/17/c7/17c703445f134eb3d7ecc7918dda2762/0124596096v2.jpeg)

:quality(80)/p7i.vogel.de/wcms/2a/2c/2a2cffc07f51019065387cd63241b5ce/0119463370v1.jpeg)

:quality(80)/p7i.vogel.de/wcms/b1/7e/b17ea8c62ccafad1d1fb072d6199bbd6/0118578446.jpeg)

:quality(80)/p7i.vogel.de/wcms/a3/f6/a3f6cf659bef4a255272c8af711c20af/0128599957v2.jpeg)

:quality(80)/p7i.vogel.de/wcms/d7/b4/d7b4415fef8a0be11c7f8fd4197edc92/0128599865v2.jpeg)

:fill(fff,0)/images.vogel.de/vogelonline/companyimg/2000/2093/65.jpg)

:fill(fff,0)/p7i.vogel.de/companies/5f/98/5f98fbb2e7bf2/05-trm-filter-logo-with-slogan-en-alt.png)

:fill(fff,0)/p7i.vogel.de/companies/68/c8/68c815bc8fe81/prominent-logo-300x300.jpeg)

:quality(80)/p7i.vogel.de/wcms/0b/c2/0bc2d35b3728c6155bcdc18aa0b4f43e/0128940631v2.jpeg)

:quality(80)/p7i.vogel.de/wcms/98/45/9845e26160beb00e36375a1f18d589b4/0124647971v3.jpeg)